How embedded finance is transforming the gig economy

Gig workers expect more from their platforms

Today, 36% of American workers identify as gig workers—up from 27% in 2016. By 2027, more than half the workforce will be gig workers.

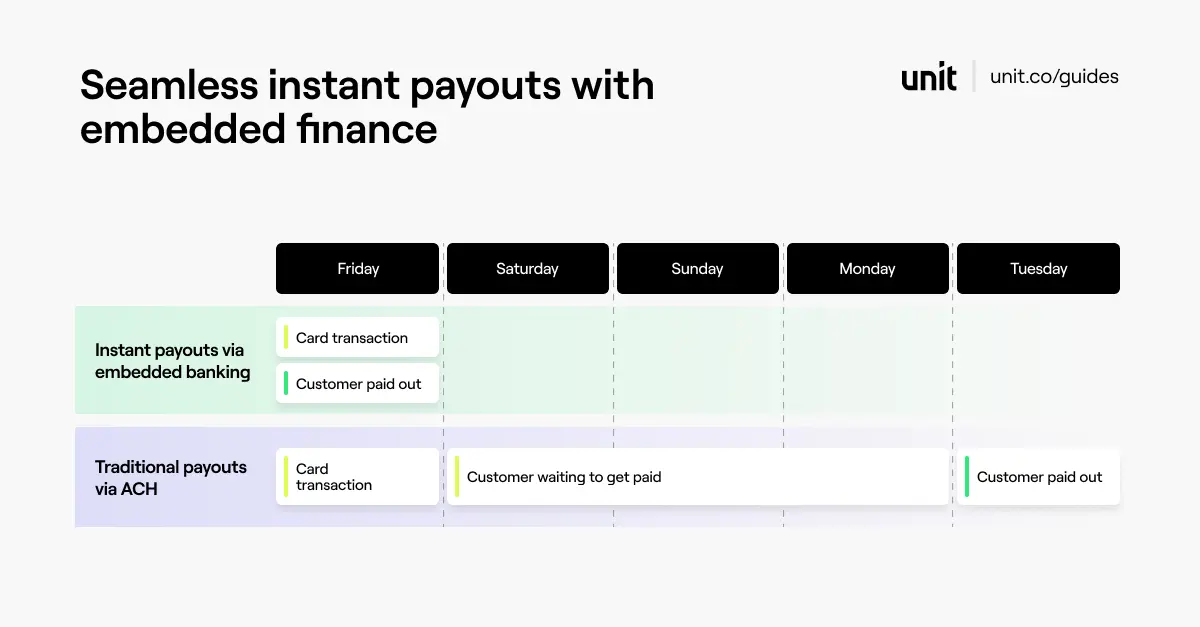

Increasingly, these workers expect to be paid on demand. The reason is simple: when cash is tight, waiting 2-5 days to get paid out via ACH is unacceptable.

In fact, nearly 80% of gig workers report having less than $500 saved for an emergency. Close to 90% say they would choose one gig platform over another if they could get paid out instantly, with no fees.

That’s why leading gig-economy platforms like Uber, Instacart, and Lugg now offer instant payouts. When their workers have completed an assignment, the funds can be accessed in their bank accounts within moments, either automatically or via a button in the app.

There are several ways to offer instant payouts, including same-day ACH, dedicated vendors, and FedNow. But these solutions are challenging to implement, and they all function as cost centers rather than revenue generators.

By contrast, embedded finance enables instant payouts in a way that generates revenue—as well as engagement, retention, and valuable customer data.

If you’re a product leader at a gig-economy platform or marketplace who’s thinking about how to pay your workers faster, this guide is for you. In it, we’ll explain:

- The value of offering embedded finance

- How it works for gig economy platforms

- What it could look like on your platform

- How to get started

The value of embedded finance for gig-economy workers

By offering embedded finance, you can solve problems for your workers that aren’t easily addressed by traditional banks.

This can be particularly impactful for gig workers, many of whom are underbanked. By providing them fast and simple access to a bank account, you can deepen your relationship with them—making your product stickier.

Gig platforms that offer embedded finance can also provide:

- Instant payouts. For gig workers, cash flow is a serious concern; 68% of workers want faster, more flexible payments. Instant payouts ensure your workers are paid as soon as they complete a job.

- Financial security. 94% of workers associate faster pay with greater financial peace of mind. Platforms that offer embedded finance can provide more financial stability and help their workers feel more confident.

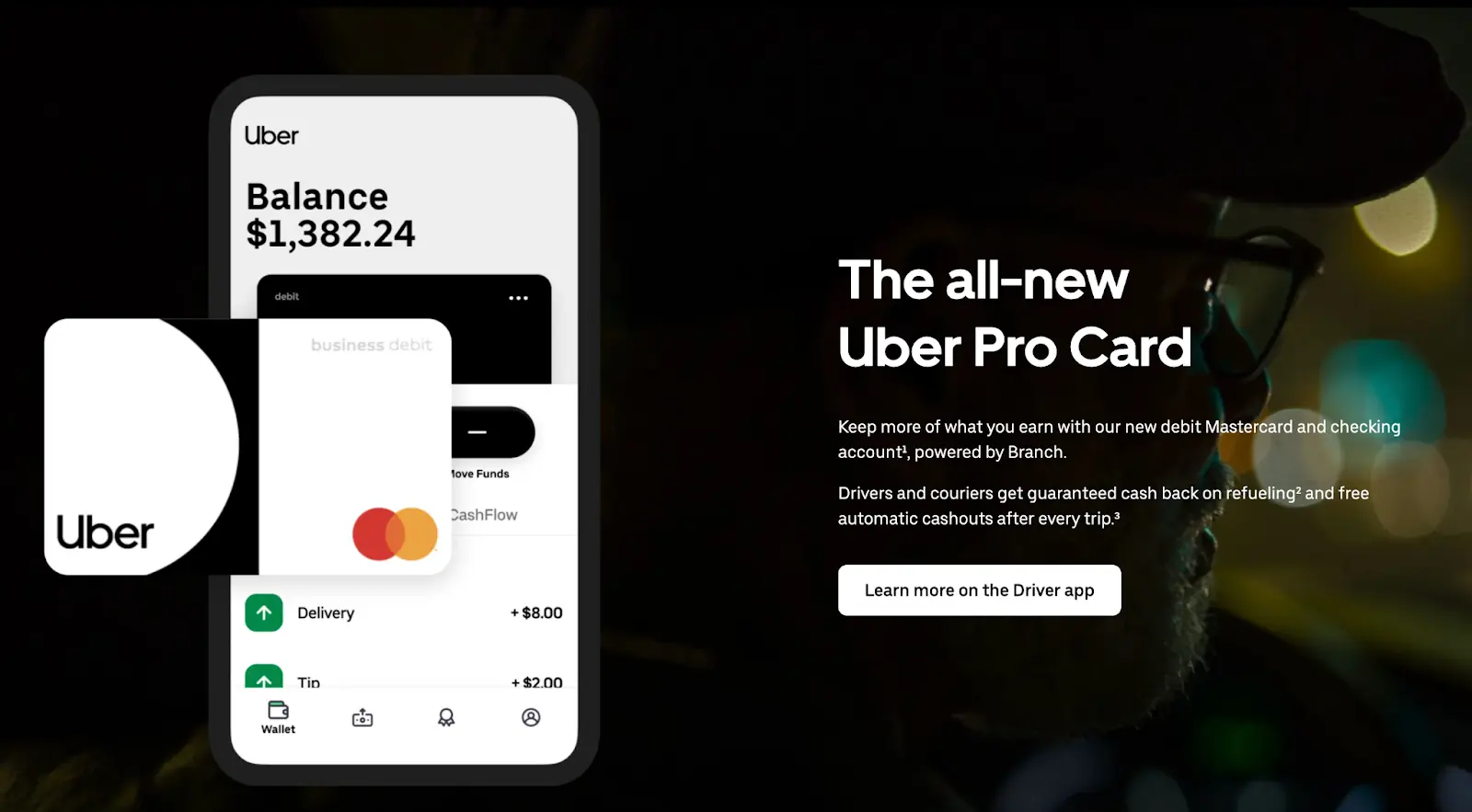

- Tailored rewards. You can provide rewards designed for the needs of your workers. For example, the Uber Pro Card offers up to 10% cashback on gas—a benefit that can be particularly appealing to drivers and couriers.

- Cash advances. Getting access to needed funds can be difficult for gig workers, many of whom lack an established credit history. As a gig-economy platform, you have unique insights into your workers’ cash flow and their ability to repay; this makes it relatively easy to offer transparent cash advances with lower risk.

- A single platform. Gig workers typically work for several platforms. Managing their finances (e.g., taxes, credit cards, banking) across different jobs can quickly turn into a big headache. By offering solutions like banking and bookkeeping, you can streamline routine tasks—saving your workers time and energy.

How embedded finance benefits gig-economy platforms

Instant payouts aren’t just valuable for your workers. They also generate the following benefits for your business:

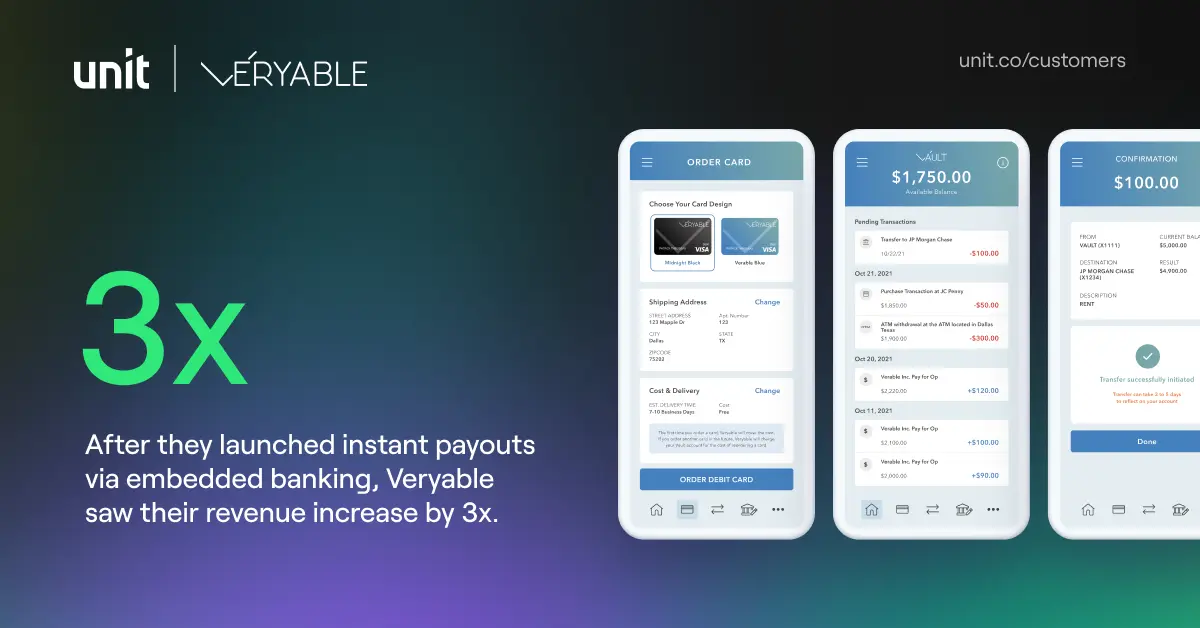

- Revenue. Embedded finance can increase your revenue per user by 2-5x; for example, when Veryable launched banking with Unit, they tripled their debit-card revenue. It’s also possible to generate multiple streams of revenue, like interchange fees from card purchases and interest earned on deposits.

- A better workforce. When you offer a better product (e.g., rewards for on-time deliveries and positive reviews), you attract and retain more reliable, efficient workers. This is attractive to the businesses who hire your workers; they’re willing to pay more for great workers, which increases revenue for your platform.

- Retention. When you offer embedded bank accounts, customers are more likely to onboard with your platform—and stick with it. For example, Roofstock found that customers who use their financial products are retained at a rate 3.5x higher than other users.

- Engagement. Bank accounts are a powerful reason for your customers to return to and engage with your product. As an example, customers who bank with Nav are 2.5x more likely to use additional products from Nav.

Finally, embedded finance creates new opportunities for re-engaging your workers. As an example, let’s say that a worker has a $1000 rent payment coming up, but there is only $800 in their account. You could let them know how many hours they need to work to make up the difference.

How embedded finance works for gig economy platforms

To illustrate how it works when a gig economy platform offers embedded finance, let's use a real-world example: Veryable.

Veryable is a platform that connects gig-economy workers with contract labor opportunities at warehouses and fulfillment centers. Veryable’s contractors wanted faster access to their money, and Veryable leapt at the opportunity to help them.

After they launched embedded bank accounts with Unit, Veryable could easily pay contractors within 24 hours of completing a work opportunity—even on holidays and weekends.

Say a contractor completes a work opportunity at a warehouse. Veryable provides the instant payout from their operational account; the funds become available in the contractor’s Veryable Vault account the next morning. Once the original payment from the warehouse has settled, Veryable recoups the funds.

Since they’ve started offering instant payouts via embedded finance, Veryable has seen sharp increases in engagement, retention, and revenue: they’ve doubled the number of customers on their platform while tripling revenue from card purchases.

What embedded finance could look like on your platform

To illustrate what embedded finance could look like on your platform, let’s use an example. Say you’re the VP of Product at Alfalfa, a platform that enables people to order organic produce and groceries and have them delivered.

Here's what embedded finance could look like. (To get a closer look at Alfalfa, check out our live demo.)

Instant payouts

Once a worker completes a work opportunity, they could tap a button in their Alfalfa Wallet to instantly access the funds in their embedded bank account.

Alternatively, you could arrange for them to be paid out automatically, within seconds of completing a job, as Uber does. In some cases, you may even be able to charge a fee for this convenience. For instance, DoorDash charges a small fee to receive payments on-demand instead of weekly.

Credit, debit, and charge cards

Credit, debit, and charge cards are a convenient way for your workers to get paid and spend money. Cards can be offered in virtual or physical form.

Virtual cards are particularly appealing because your workers can start spending with them as soon as they’re issued. They’re also highly programmable; for example, you could allow workers to set a weekly spending limit to help them manage their personal finances.

Bank accounts

When you offer your customers embedded bank accounts, you gain visibility into all of their account activity—while also generating revenue from it.

Your workers could access embedded bank accounts via a tab in the Alfalfa app. To differentiate your product from traditional bank accounts, you could offer more detailed information about income and expenses; for example, when income was earned and for which job.

Cash advances

Cash advances are a popular form of lending offered by gig-economy platforms like DoorDash and Toast.

With cash advances, you purchase a portion of your worker’s future revenues in exchange for early access to funds they expect to receive in the near future. Cash advances can help your workers access needed funds while unlocking a powerful revenue driver for you.

ATM access

For many gig-economy workers, cash is a primary way to pay and get paid. So it's important to give your workers a way to access cash with their embedded bank accounts.

At Unit, we’ve partnered with Allpoint Network to offer fee-free ATM access at over 55,000 ATMs. We also enable end-customers to search for nearby ATMs.

Automated tax withholding

Once your workers get paid, you can make it easy for them to understand what they may owe in taxes.

For example, you could provide an opt-in feature that automatically deposits the appropriate amount into a dedicated “tax account” whenever your worker gets paid.

Targeted rewards

Targeted rewards programs can set you apart from competitors, drive engagement, and increase retention. Uber does this to great effect with the Uber Pro Card; for example, drivers can earn up to 10% cashback on gas.

Integrations with popular apps and services

Your workers depend on apps like CashApp and Venmo; embedded banking makes it simple to integrate with them. You can also integrate with platforms like Hurdlr and Quickbooks, which help gig workers more easily manage activities like bookkeeping and taxes.

Other payment options

Besides instant payouts, you could support payment methods like same-day ACH, check payments, push-to-card payments, and international payments. For example, your workers may prefer to pay their rent via check; with embedded finance, it’s easy to offer them this functionality.

How to get started

When considering whether and how to launch embedded finance, many tech leaders are curious about the up-front investment.

- What’s my time to market?

- How much will it cost?

- What kind of staffing is required?

As recently as five years ago, it required years and millions of dollars. But with recent advances in technology, it’s now possible to launch embedded finance in weeks.

How Unit can help

Unit is an embedded financial infrastructure platform that helps tech companies build accounts, cards, payments, and lending into their products.

That means we help gig-economy platforms like yours launch instant payouts, banking, and lending. To date, nearly 200 leading platforms and marketplaces have trusted us to help them build and scale their programs.

Unit is also the only platform to offer White-Label Components—a suite of fully customizable building blocks—so you can easily build and control your frontend with minimal engineering resources. We streamline compliance requirements and bank relationship(s) so you can stay focused on scaling your business.

If you’re thinking about how instant payouts can help you better retain and engage your workers, please reach out. We’d love to brainstorm with you.